Intel’s recent earnings report triggered a seismic shockwave through the tech industry. The chip giant announced a series of drastic measures, including massive job cuts, dividend suspension, and a significantly lowered revenue outlook. These actions were a direct response to underwhelming financial performance and intensifying competition from rivals like AMD.

The broader economic implications are substantial. Intel’s struggles underscore the challenges faced by the semiconductor industry as a whole. Despite government initiatives like the Chips Act aimed at bolstering domestic chip production, the sector remains highly competitive and vulnerable to economic downturns.

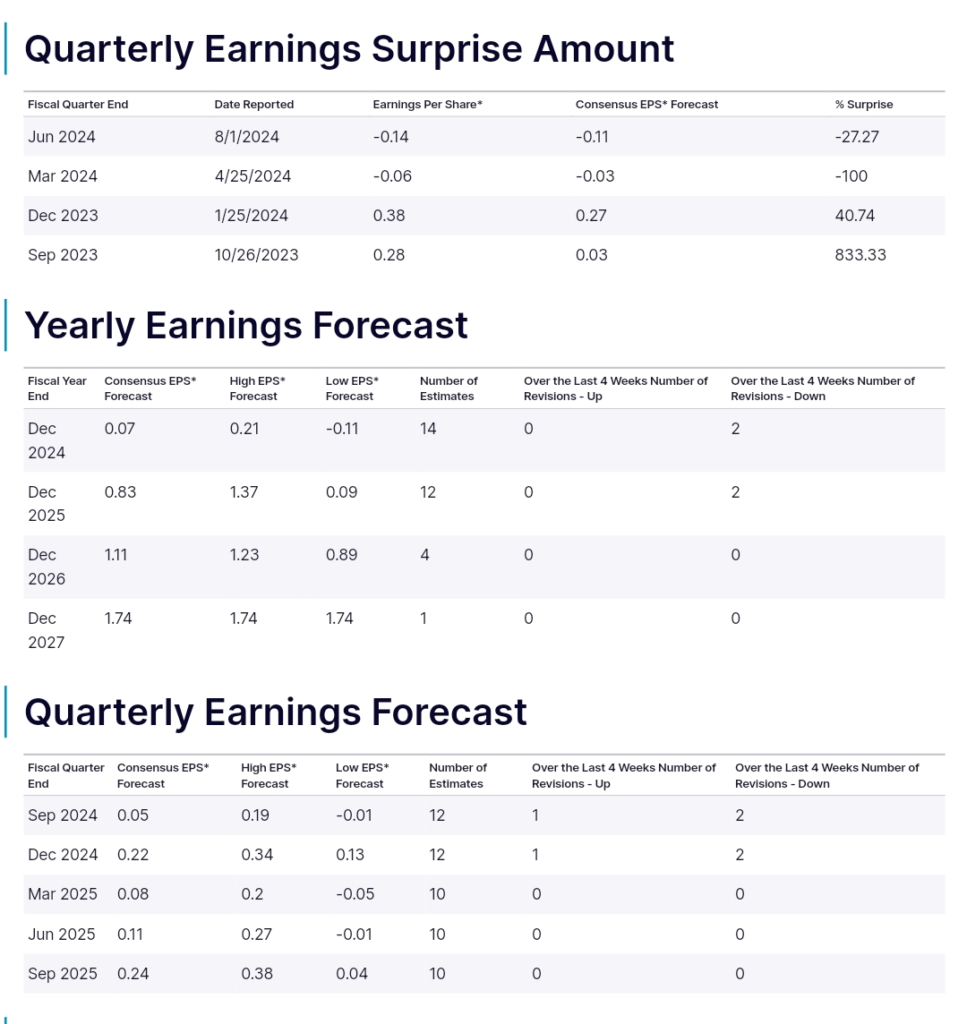

Stock market reactions were swift and severe. Intel’s share price plummeted by 26% in a single day, reflecting investor pessimism about the company’s future. While the broader tech sector has been volatile, Intel’s performance magnified existing concerns about a potential economic slowdown.

The industry landscape is shifting rapidly. AMD has emerged as a formidable competitor, outperforming Intel in key market segments. This competitive pressure, coupled with declining PC sales and increasing operational costs, has forced Intel to undertake a painful restructuring.

While the situation is dire, Intel remains a strategic asset for the United States due to its critical role in the semiconductor supply chain. However, the company faces a long road to recovery and regaining investor confidence.

Key takeaways:

- Intel’s poor performance reflects broader challenges in the semiconductor industry. Intel reported total revenue of $12.84 billion, down 1.0 percent, Revenue missed analyst expectations by $150 million, according to Seeking Alpha.

- Intel Foundry side, the company reported revenue of $4.32 billion, up from $4.17 billion.

- The company’s drastic measures indicate a severe crisis.

- AMD’s success highlights the competitive landscape.

- The US government’s push for domestic chip production is crucial but faces hurdles.

- Intel’s future remains uncertain despite its strategic importance.

- Intel will suspend its $0.125 per share quarterly dividend. The last payout before the suspension is scheduled for September 1st, 2024.

Share your thoughts!

Can Intel quickly reinvent itself and regain a position as a tech leader? Does Intel’s Foundry side provide enough growth to keep the company relevant?

Leave a Reply