Are you looking to supercharge your portfolio growth and potentially achieve exponential returns? The traditional investment strategies may feel slow and limited. Enter the “Borrow, Split, Repeat” strategy, a dynamic leverage approach designed to amplify your investment potential. This method utilizes borrowed capital to propel your portfolio forward, but with a crucial twist: a strategic split reinvestment to fuel further growth.

This article will delve into the mechanics of the “Borrow, Split, Repeat” strategy, exploring how it can potentially unleash compound growth. We’ll also analyze the key differences between this approach and the “Buy, Borrow, Die” strategy, highlighting the unique focus on a wider range of assets and the emphasis on reinvestment. However, it’s crucial to understand that leverage comes with inherent risks, and we’ll explore these in detail along with the mathematical considerations of the strategy.

By the end of this exploration, you’ll gain a comprehensive understanding of the “Borrow, Split, Repeat” strategy, its potential benefits, and the critical factors to consider before implementing it in your own investment journey. Remember, responsible investing requires thorough research, a high tolerance for risk, and potentially the guidance of a qualified financial professional.

Borrow, Split, Repeat: Demystifying the Mechanics:

The “Borrow, Split, Repeat” strategy hinges on strategically leveraging borrowed capital to potentially accelerate your portfolio’s growth. Unlike some traditional leverage approaches, this method goes beyond simply acquiring assets through debt. It incorporates a unique approach to “pay yourself first” while also facilitating reinvestment for potential long-term growth.

Borrowing with Flexibility:

The first step involves taking a calculated loan. Unlike a traditional loan for a car or house, the strategy recommends a dynamic loan amount based on market conditions. During favorable market conditions (bull markets), borrowing a higher percentage of your portfolio value allows you to potentially capitalize on rising asset prices. Conversely, during downturns (bear markets), the strategy suggests borrowing a lower percentage or even pausing borrowing entirely to mitigate risk.

“Pay Yourself First” and Reinvest for Growth:

Once you secure the loan, the core “Borrow, Split, Repeat” principle comes into play. You’ll strategically allocate a portion of the loan towards “paying yourself first.” This can be achieved through various methods, such as directly receiving a portion of the loan as income or using it to cover essential expenses. This approach aims to reduce your reliance on traditional income sources and potentially free up existing income for other purposes, like additional investments.

The remaining portion of the loan is then strategically reinvested back into your chosen asset(s). This reinvestment fuels compounding growth. By leveraging the borrowed capital, you’re essentially increasing your overall investment base and potentially amplifying your returns over time.

Asset Diversification:

The “Borrow, Split, Repeat” strategy offers flexibility in asset selection compared to strategies like “Buy, Borrow, Die,” which often focus on real estate. You can choose to invest your reinvested capital in a variety of assets that align with your risk tolerance and investment goals. This could include stocks, bonds, real estate, or even cryptocurrencies. Remember, thorough research and understanding the inherent risks associated with each asset class are crucial.

Continuous Management:

Implementing the “Borrow, Split, Repeat” strategy is an ongoing process. You’ll need to continuously manage loan repayments, potentially utilizing dividends earned on your investments or additional contributions to accelerate repayment and reduce your debt burden. Additionally, strategic asset sales may be considered based on tax implications and loss thresholds. For example, you might sell an asset if it experiences a significant decline in value to minimize potential losses or if you’ve held it for over a year to qualify for long-term capital gains tax rates.

By understanding these core mechanics, you gain a foundational knowledge of how the “Borrow, Split, Repeat” strategy functions. However, it’s crucial to remember that this is a simplified overview. There are significant risks and complexities involved, which we will explore in detail in the following sections.

It’s important to note that the strategy’s ability to provide “tax-free income” through borrowed money needs careful consideration and verification with a qualified financial advisor. Tax laws are complex and can vary depending on individual circumstances and jurisdictions.

Borrow, Split, Repeat: Unveiling the Risks:

While the “Borrow, Split, Repeat” strategy presents the potential for amplified returns, it’s crucial to acknowledge the inherent risks involved before considering its implementation. This approach is not suitable for everyone and requires a high tolerance for risk, extensive financial knowledge, and careful risk management practices. Here are some key risks to consider:

Market Volatility:

Borrowing amplifies both potential gains and losses. By leveraging borrowed capital, you essentially magnify the impact of market fluctuations. During downturns (bear markets), asset values can decline significantly, making it challenging to repay the loan if the value of your investments falls below the loan amount. This can lead to margin calls, forcing you to sell assets at potentially unfavorable prices to meet your loan obligations.

Rising Interest Rates:

The strategy relies on borrowing capital. If interest rates rise, your borrowing costs will increase, making loan repayments more expensive. This can strain your cash flow and potentially eat into your investment returns.

Tax Implications:

The “Borrow, Split, Repeat” strategy involves various financial transactions that carry tax implications. Selling assets, receiving income from the “pay yourself first” portion, and managing loan repayments can all trigger taxable events. Consulting with a tax advisor is crucial to understand the potential tax ramifications and minimize their impact on your overall returns.

Complexity and Potential for Missed Opportunities:

Implementing and managing the “Borrow, Split, Repeat” strategy requires significant financial knowledge and expertise. It involves navigating complex financial instruments, market analysis, and strategic decision-making. Additionally, the reliance on market timing for dynamic loan amounts and asset sales can be challenging. Missing the right entry or exit points for investments can significantly impact your returns, potentially negating the potential benefits of the strategy.

Over-Leverage:

The core concept of the strategy involves borrowing capital. However, excessive borrowing can create a precarious financial situation. If the strategy underperforms or market conditions deteriorate significantly, you may find yourself with a large debt burden and limited resources to manage it.

Remember, this list is not exhaustive, and the specific risks associated with the “Borrow, Split, Repeat” strategy can vary depending on your individual circumstances, financial goals, and risk tolerance. Thorough research, seeking professional guidance, and prioritizing responsible investment practices are crucial before considering this or any complex investment strategy.

Borrow, Split, Repeat: Exploring the Math (Simplified Model):

The “Borrow, Split, Repeat” strategy offers a potential path to accelerate portfolio growth, but remember, past performance is not indicative of future results, and any investment carries inherent risks. Examining the strategy’s potential returns solely based on hypothetical examples can be misleading. However, a simplified mathematical simulation can provide a general understanding of the potential impacts under different scenarios:

Assumptions:

- Starting Portfolio Value: $100,000

- Annualized Investment Return:

- Bull Market: 10%

- Bear Market: -5%

- Loan Interest Rate: 5%

- Loan Amount as a Percentage of Portfolio Value:

- Bull Market: 25%

- Bear Market: 10%

- “Pay Yourself First” Allocation: 50% of the Loan Amount

- Reinvestment Allocation: 50% of the Loan Amount

| Year | Market Conditio | Stsrting Portfolio Value | Portfolio Value | Loan Balance | Reinvested Amount | Pay Yourself First (Total) |

| 1-5 | Bull Market | $100,00 | $161,051 | $16,462 | $8,232 | $8,231 (Year 1) – $16,462 (Year 5 – Cumulative) |

| 6-8 | Bear Market | $161,051 | $140,470 | $14,830 | $7,415 | $8,231 (Year 6) – $24,693 (Year 8 – Cumulative) |

| 9-13 | Bull Market | $140,470 | $217,023 | $7907 | $3,953 | $8,231 (Year 9) – $36,924 (Year 13 – Cumulative) |

Details:

This model simulates a 13-year period with various market conditions, showcasing the potential impact on the portfolio value, loan balance, and cumulative “pay yourself first” allocation:

- Years 1-5: Represents a bull market with a 10% annualized return, highlighting portfolio growth alongside loan repayment, reinvestment, and the ongoing accumulation of funds received through the “pay yourself first” allocation.

- Years 6-8: Represents a bear market with a -5% annualized return, demonstrating the potential impact of declining asset values on the portfolio and loan balance. However, the “pay yourself first” allocation continues.

- Years 9-13: Represents another bull market with a 10% annualized return, highlighting the potential for recovery, continued growth, and further accumulation in the “pay yourself first” total.

It’s crucial to remember that this is a simplified model with hypothetical assumptions. It does not guarantee future performance, and actual results can vary significantly depending on several factors. These factors include market conditions, the specific investment choices you make, and your individual circumstances.

Furthermore, this model does not consider the impact of taxes, fees, or transaction costs, which can all further reduce your returns. It’s important to understand these additional costs before implementing any investment strategy.

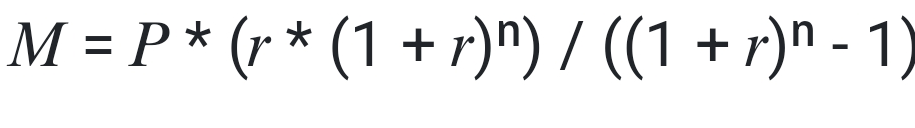

Underlying Math and Statistical Concepts:

Despite these limitations, exploring the basic mathematical principles behind the strategy can provide a foundational understanding:

- Compound Interest: The core concept relies on leveraging compound interest. By reinvesting both the initial investment and the returns earned over time, the strategy aims to accelerate portfolio growth.

- Risk-Return Tradeoff: The strategy amplifies both potential gains and losses. By borrowing capital, the investor increases their exposure to market fluctuations. While it can magnify returns during bull markets, it can also exacerbate losses during downturns.

- Loan-to-Value Ratio (LTV): This ratio measures the borrowed amount relative to the value of the underlying asset. The model demonstrates adjusting the LTV based on market conditions (higher in bull markets, lower in bear markets), aiming to mitigate risk and potentially optimize returns.

Borrow, Split, Repeat vs. Buy, Borrow, Die: A Tale of Two Strategies:

The “Borrow, Split, Repeat” strategy presents a unique approach to potentially accelerate portfolio growth through strategic leverage. But how does it stack up against the more established “Buy, Borrow, Die” strategy? Let’s explore the core philosophies and considerations of each.

Buy, Borrow, Die: A Focus on Long-Term Appreciation

The “Buy, Borrow, Die” strategy hinges on acquiring assets, often with a focus on real estate, primarily through borrowed capital. The core philosophy revolves around leveraging appreciation. You borrow money to purchase assets that are expected to increase in value over time. The strategy emphasizes holding onto these assets until your passing, with the potential to avoid capital gains taxes on the accrued appreciation.

This approach offers relative simplicity and the potential to leverage asset appreciation for faster wealth accumulation. However, there are significant drawbacks. “Buy, Borrow, Die” relies heavily on a continuously rising market. Asset selection is limited, and there’s minimal flexibility to adapt to changing market conditions. During market downturns, the risk of margin calls forcing asset sales at unfavorable prices is high. Additionally, potential tax implications upon the owner’s death can be substantial.

Borrow, Split, Repeat: Flexibility and Active Management

The “Borrow, Split, Repeat” strategy utilizes borrowed capital strategically, aiming to amplify investment returns. Here, borrowed funds are split between reinvestment and a “pay yourself first” allocation. This strategy leverages market conditions by allowing for dynamic adjustments to loan amounts. Higher loan amounts are used during bull markets, while bear markets see a decrease in borrowed capital.

This approach provides greater flexibility in asset selection compared to “Buy, Borrow, Die.” It also offers the potential for an ongoing income stream through the “pay yourself first” allocation. The ability to adjust loan amounts based on market conditions allows for a more dynamic approach. However, the complexity of “Borrow, Split, Repeat” requires active management. The strategy carries higher risks due to potential for rising interest rates and market downturns. The ongoing transactions associated with the strategy also necessitate careful consideration of tax implications.

Choosing the Right Strategy for You

The ideal strategy depends on your individual circumstances, risk tolerance, and investment goals. Here’s a quick guide to help you decide:

- “Buy, Borrow, Die” might be a better fit if: You favor a simpler strategy, are comfortable with a long-term focus on real estate appreciation, and have a high tolerance for risk.

- “Borrow, Split, Repeat” could be a better choice if: You value flexibility in asset selection, desire a potential ongoing income stream, and are comfortable with a more complex, actively managed approach.

Remember: Both “Borrow, Split, Repeat” and “Buy, Borrow, Die” carry significant risks. It’s crucial to conduct thorough research, understand the inherent risks involved, and seek professional guidance before implementing either strategy. Carefully consider your investment horizon, risk tolerance, and overall financial goals to determine the approach that best aligns with your needs. Responsible investing involves prioritizing financial stability and seeking professional advice to build a well-diversified portfolio for the long term.

Leave a Reply