Author: finance.growthvessel.com

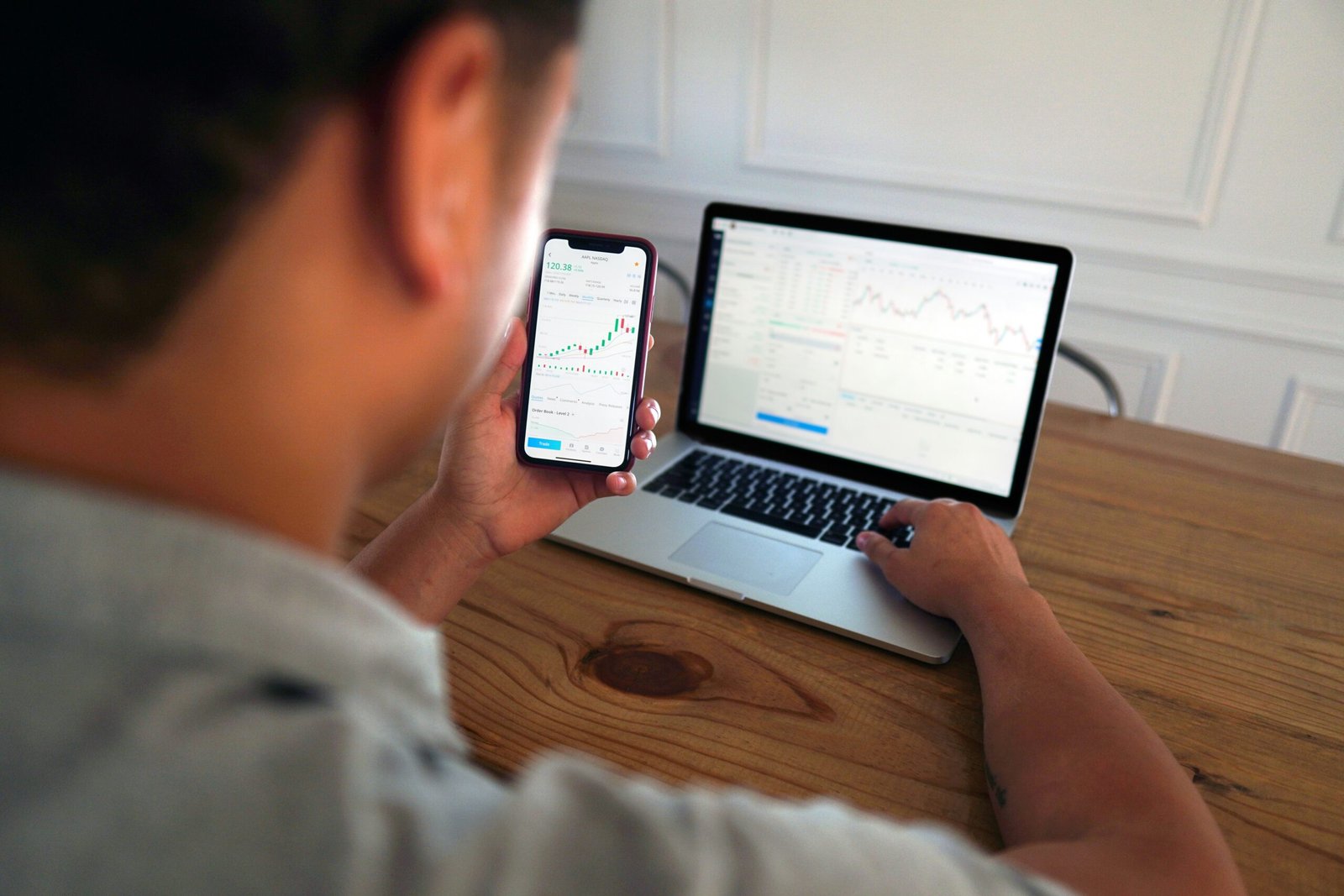

Closer Look At Robinhood Q2 Earnings: Growth Play?

•

Robinhood’s second-quarter earnings report showcased a company capitalizing on the surge in retail trading activity, particularly in cryptocurrencies and options. The significant revenue growth and increase in active users underscore the platform’s ability to attract and retain customers amidst a dynamic market. While the earnings beat market expectations, the lackluster…

The New Intel: Dismal Performance, Job Cuts, And Dividend Suspension

•

Intel’s recent earnings report triggered a seismic shockwave through the tech industry. The chip giant announced a series of drastic measures, including massive job cuts, dividend suspension, and a significantly lowered revenue outlook. These actions were a direct response to underwhelming financial performance and intensifying competition from rivals like AMD.…

How To Finance: Learn to Save like A Millionaire

•

Saving money is a cornerstone of financial wellness. It’s the foundation for building a secure future, achieving your financial goals, and gaining peace of mind. Having a healthy savings account empowers you to weather unexpected financial storms, from car repairs to medical emergencies. It also allows you to invest in…

How to Invest with Mutual Funds? A Look at Pros, Cons & Strategies

•

Mutual funds have carved a niche in the world of investing, particularly for retirement planning. But are they a one-size-fits-all solution? Let’s delve into the reasons why mutual funds excel at growing your nest egg for retirement, while also exploring why they might not be the best fit for your…

How to Finance: Learn the Basics of Financing

•

Financial literacy empowers you to take control of your money and make informed decisions about your financial future. It’s the key to unlocking a sense of security and freedom. Imagine feeling confident about your financial situation, knowing you can cover your bills and have a plan for the future. This…

Creative Financing: Seller-Backed – Unlock Real Estate with Minimal Cash Down

•

In our exploration of creative financing methods, we now delve into the world of Seller-Backed Deals, also known as Owner Financing. This strategy involves securing a property directly from the seller, who acts as the lender, financing a portion of the purchase price for you. Imagine bypassing the limitations of…

Creative Financing: How to secure deals using Subject-To

•

In the first article of our Creative Financing Series, we introduced you to the exciting world of alternative financing methods. Today, we’ll delve into the details of Subject-To financing, a strategy that can revolutionize your approach to property acquisition. What is Subject-To Financing? Imagine buying a property without needing a…

Creative Financing: Unlock The Secrets To Real Estate Riches

•

Have you ever dreamt of owning real estate but felt discouraged by the hefty down payments and strict bank loan requirements? Then creative financing might be the key to unlocking a world of possibilities! This article series will be your comprehensive guide to navigating the exciting world of creative financing.…

Layoffs on the Rise but Unemployment Rate Holds Steady

•

Despite significant job cuts across various industries in 2023 and early 2024, the unemployment rate has only increased slightly. This apparent disconnect between rising layoffs and a slow rise in unemployment has puzzled economists and job seekers alike. A survey by ResumeBuilder found that nearly 40% of business leaders anticipate…

Fallen Consumer Sentiment: Why And How To Protect Yourself

•

A recent survey by the University of Michigan revealed a significant decline in consumer confidence. This is due to anxieties about inflation, unemployment, and rising interest rates dampening economic optimism 1. This drop in sentiment has the potential to send shockwaves through the economy, impacting businesses, investors, and households alike.…

How to Payoff Debt: Your Guide to Financial Freedom

•

Debt. It’s a four-letter word that can strike fear into the hearts of even the most financially responsible individuals. According to a 2023 Experian report, the average U.S. consumer carries over $92,727 in total debt, excluding mortgages [1]. This burden can feel overwhelming, but there is hope! This guide equips…

HELOCs In A High-Interest Rate Environment: Boon Or Mistake?

•

Home equity lines of credit (HELOCs) have become a popular financial tool for homeowners. They offer a revolving line of credit, similar to a credit card, but with interest rates typically lower than unsecured credit options. But with rising interest rates becoming a pressing concern for many, is a HELOC…

Housing Market Slowdown And It’s Impact On The Economy

•

The housing market, once a red-hot engine of the US economy, is exhibiting signs of a cooldown in 2024. This shift comes amid rising interest rates, which have dampened homebuying demand and sent ripples through the broader economy. Rising Rates, Cooling Demand According to a CNBC report, mortgage demand has…

Hidden Wealth Gem: Stock Options! Elon’s Compensation

•

Resurfaced Controversy: Re-voting on Musk’s Compensation Electric car leader Tesla finds itself back in the spotlight regarding CEO Elon Musk’s compensation package. A recent Yahoo Finance article revealed Tesla’s request for shareholder re-approval of a $56 billion pay deal for Musk, previously rejected by a Delaware court. This development coincides…

Building Futures, One Investment at a Time: Using Life Insurance

•

Safeguarding Your Child’s Future: Exploring Life Insurance Options Building wealth for your child extends beyond investment accounts and trusts. Life insurance provides a unique layer of protection, ensuring your child’s financial security even in your absence. While trusts offer a powerful tool for managing assets over the long term, life…

Building Futures, One Investment at a Time: Understanding Trusts And Their Role In Wealth Growth

•

Custodial brokerage accounts, 529 plans, and Roth IRAs offer well-established methods for growing wealth for your child. However, trusts provide a unique and sophisticated approach, particularly appealing for those seeking more control over asset distribution, asset protection, and potential tax benefits. Trusts can be especially useful for families with significant…

Bond Yields On The Rise: The Corrnerstones Of The Financial System And Economy

•

Bonds: Cornerstones of the Financial System and Influencers of the Economy Bonds are a bedrock of the financial system, acting as instruments wielded by governments and corporations to secure capital. When you invest in a bond, you’re essentially providing a loan to the issuer in exchange for regular interest payments…

Walmart Settles Over Pre-Packaged Groceries: Find Out How To Claim Your Portion

•

Walmart shoppers who frequented the retail giant between October 2018 and January 2024 have until June 5th, 2024, to claim a portion of a $45 million class-action settlement. The lawsuit alleged that Walmart overcharged for certain pre-packaged groceries, specifically sold-by-weight meat, poultry, seafood, and some bagged citrus fruits. Walmart maintains…

Building Futures, One Investment at a Time: Custodial Brokerage Account

•

Investing for your child’s future extends far beyond their immediate needs. While 529 plans cater to college savings and Roth IRAs focus on retirement, a custodial brokerage account offers a flexible and versatile platform to cultivate long-term wealth for your child. Unlike retirement accounts with contribution limits and withdrawal restrictions,…

Building Futures, One Investment At A Time: Custodial Roth IRA

•

Securing your child’s financial future extends well beyond their college years. A Roth IRA serves as a powerful tool to jumpstart their long-term financial security, fostering a lifelong habit of saving and investing. Unlike 529 plans designated for education, Roth IRAs empower your child to accumulate wealth for a diverse…